Physician Home Loans in Long Beach | Are Homeowners Renovating to Sell or to Stay?

At Physician Loans USA , we don’t want you to feel overwhelmed; we don’t want you to feel like you are lost or alone in whatever you are confronting. We are here to guide you on selecting Long Beach properties.

Today I would like to talk to you about Physician Home Loans in Long Beach | Are Homeowners Renovating to Sell or to Stay?

Over the past few years, two trends have emerged in the housing market:

Home renovations have shot up

Inventory of homes available for sale on the market has dropped

A ‘normal’ housing market is defined by having a 6-month supply of homes for sale. According to the latest Existing Home Sales Report from the National Association of Realtors, we are currently at a 4.4-month supply.

This low inventory environment has many current homeowners worried that they would be unable to find a home to buy if they were to list and sell their current houses, which is causing many homeowners to instead renovate their homes in an attempt to fit their needs.

According to Home Advisor, homeowners spent an average of $6,649 on home improvements over the last 12 months. If that number seems high, it also includes homeowners who recently bought fixer-uppers.

A new study from Zillow asked the question,

“Given a choice between spending a fixed amount of money on a down payment for a new home or fixing up their current home, what would you do?”

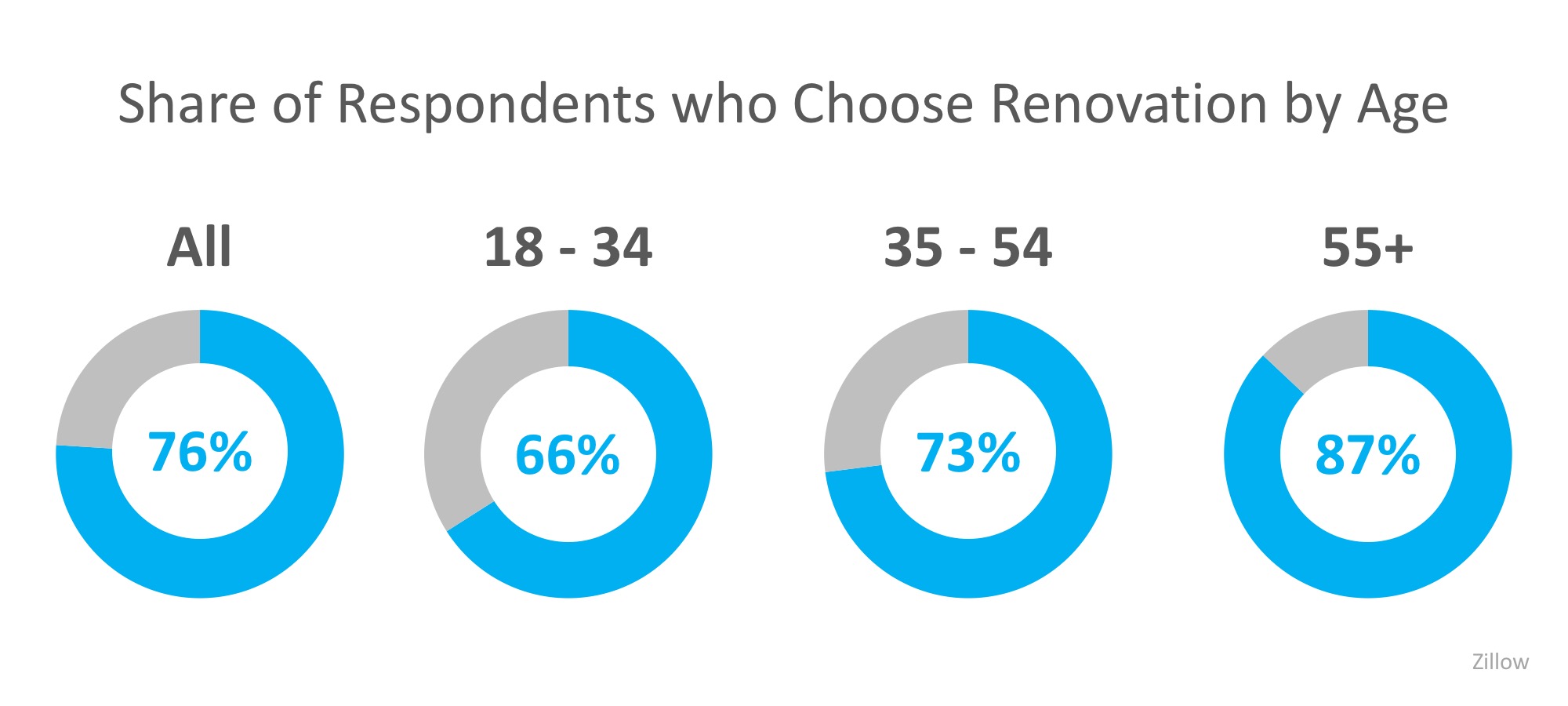

Seventy-six percent of those surveyed said that they would rather renovate their current homes than move. The results are broken down by generation below.

More and more studies are coming out about the intention that many Americans have to ‘age in place’ (or retire in the area in which they live). Among retirees, 91% would prefer to renovate than spend their available funds on a down payment on a new home.

If their current house fits their needs as far as space and accessibility are concerned, then a renovation could make sense. But if renovations will end up changing the identity of the home and impacting resale value, then the renovations may end up costing them more in the long run.

With home prices increasing steadily for the last 6.5 years, homeowners have naturally gained equity that they may not even be aware of. Listing your house for sale in this low-competition environment could net you more money than your renovations otherwise would.

Bottom Line

If you are one of the many homeowners who is thinking about remodeling instead of selling, let’s get together to help you make the right decision for you based on the demand for your house in today’s market.

At Physician Loans USA, we have a staff that you can connect with via phone or e-mail. Our corporate promise to you is that we will be same business day of your initial inquiry. We take pride in helping relocating physicians throughout the country, and understand the hectic schedule your profession demands.

PLEASE CHOOSE A STATE BELOW AND WE WILL CONTACT YOU DIRECTLY TO GET STARTED.

Physician Loans USA, Real Estate Solutions for Doctors, matches borrowers with potential lenders and agents in the field of mortgage lending, home buying and relocation services.

To connect with us directly,

Please call Mike at 833-437-5626

Or via email: INFO@PHYSICIANLOANSUSA.COM

Visit us at www.physicianloansusa.com

Call or text 833-437-5626 for more information

Search for the new listings in Long Beach by Map